Tax Revenue Falls Short in 2025, Reaching Only 87.6% of the Target

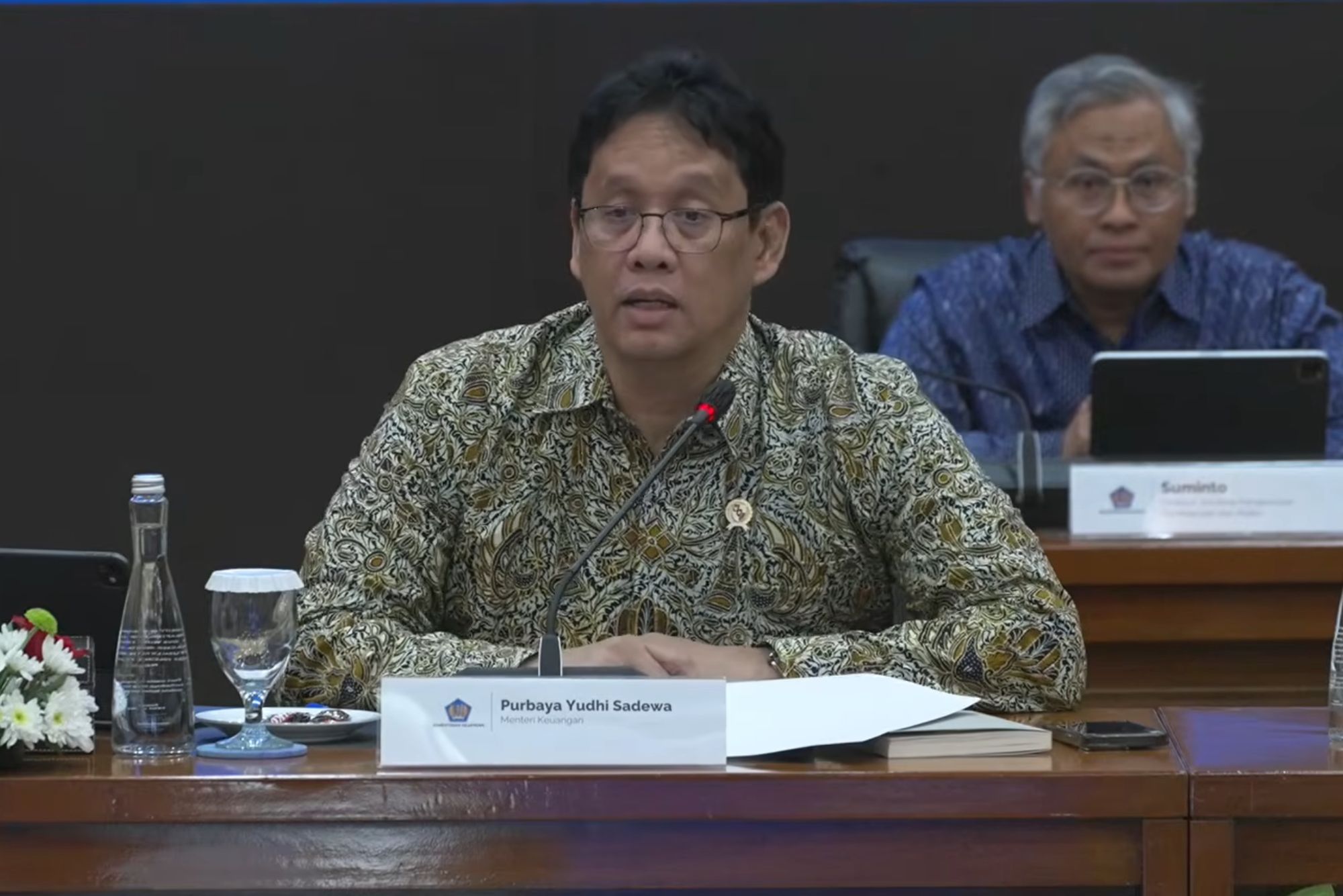

JAKARTA. Minister of Finance Purbaya Yudhi Sadewa announced that the provisional realization of tax revenue throughout 2025 reached only IDR 1,917.6 trillion.

With this achievement, tax revenue in 2025 recorded a shortfall, as it reached only 87.6% of the target set by the government in the 2025 State Budget (APBN).

Meanwhile, when compared with the government’s target based on the Second Semester Report (Lapsem II) 2025 outlook, tax revenue realization stood at 92.3%.

Previously, in the 2025 APBN, the government set a tax revenue target of IDR 2,189.3 trillion. The tax revenue target in Lapsem II 2025 was also set at IDR 2,189.3 trillion.

Contraction Due to Declining Commodity Prices

Compared with tax revenue realization in 2024, tax revenue in 2025 declined by 0.7% year on year.

This condition was influenced by several factors, including moderating commodity prices, higher tax refunds, and government fiscal policies aimed at maintaining public purchasing power.

In detail, tax revenue in 2025 consisted of:

- Corporate Income Tax: IDR 321.4 trillion

- Individual Income Tax and Income Tax Article (ITA) 21: IDR 248.2 trillion

- Final Income Tax, ITA 22, and ITA 26: IDR 345.7 trillion

- Value Added Tax (VAT) and Sales Tax on Luxury Goods (STLG): IDR 790.2 trillion

Despite the decline, the government remains confident that tax performance will improve in 2026, as reflected in the improving tax performance in the fourth quarter of 2025 compared to previous quarters. (ASP/KEN)