DGT Amends Provisions on Land and Building Tax Documents

The Directorate General of Taxes (DGT) has issued PER-4/PJ/2025, which amends PER-25/PJ/2020 and establishes changes to the format and content of Land and Building Tax (L&B tax). documents. This new regulation is intended to align tax administration with a system that is more transparent, efficient, and accountable.

The DGT has revised the provisions regarding the structure and content of documents related to Land and Building Tax through the issuance of Director General of Taxes Regulation Number PER-4/PJ/2025, which was issued and came into effect on April 29, 2025.

This regulation amends the previous provisions outlined in the Director General of Taxes Regulation Number PER-25/PJ/2020 concerning the format and content of the tax due notification letter, calculation note, PBB assessment letter, overpayment decision letter, notification letter, and PBB billing letter.

READ: Land and Building Tax Reduction Facility Updated Through PMK 129 Year 2023

In its official consideration, the DGT stated that the changes were made to adapt to a tax administration system that is more transparent, effective, efficient, accountable, and flexible.

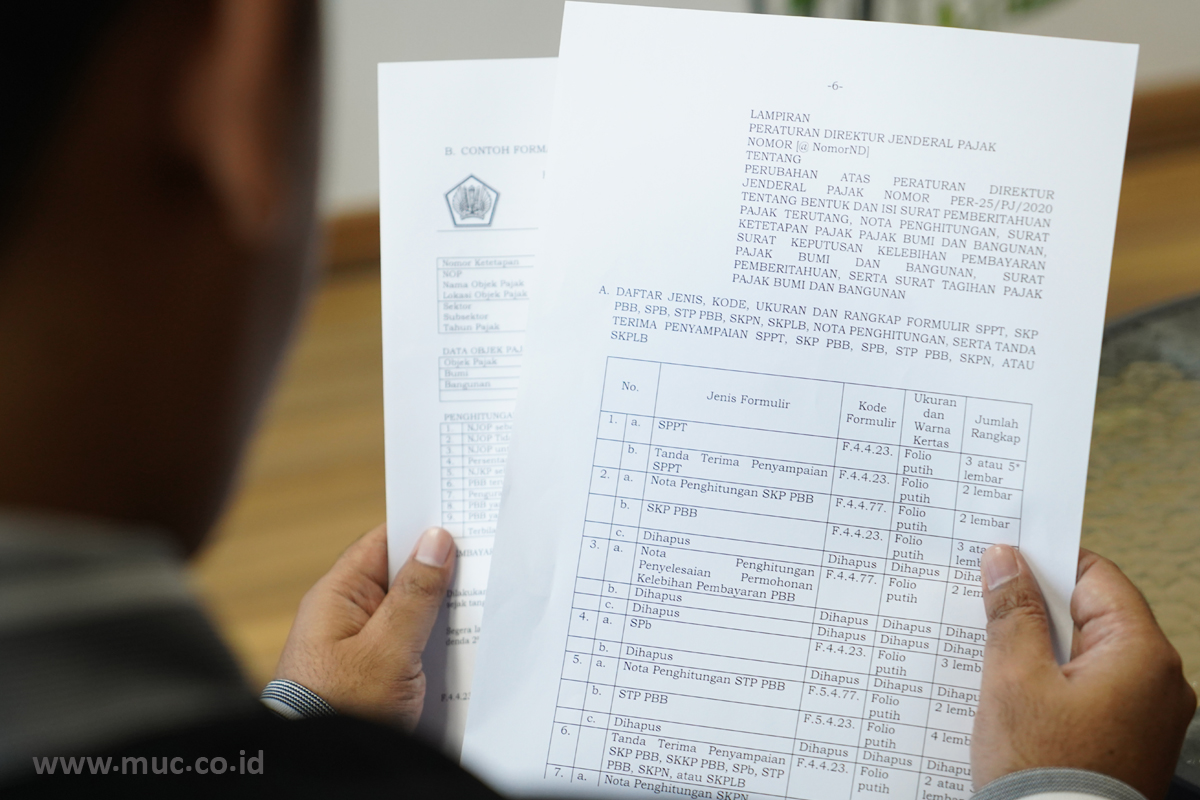

The amendments include provisions concerning the list or types of L&B Tax documents and several of their attachments.

READ: Through PMK 79/2023, DGT Can Appraise NJOP of L&B tax, Taxpayer's Assets and Businesses

List of Land and Building Tax (L&B Tax) Documents

Under the latest regulation, the Directorate General of Taxes (DGT) has removed the Overpayment Decision Notice (Surat Keputusan Kelebihan Pembayaran / SKKP) for Land and Building Tax (L&B tax) from the list of regulated documents. In its place, the DGT has added the Nil Tax Assessment Notice (SKPN) and the Tax Overpayment Assessment Notice (SKPLB) to the official list.

The SKPN is a tax assessment letter that stipulates the principal tax amount is equal to the tax credit amount, or that the tax is not payable and no tax credit exists.

The SKPLB is a tax assessment letter stating that an overpayment of tax has occurred because the tax credit amount exceeds the payable tax or because the tax should not have been due.

Changes to Attachments

Several attachments have also been modified. Attachments A, B, D, E, F, H, I, J, and K have been revised. Additionally, Attachment G from PER-25/PJ/2020 has been removed.

PER-4/PJ/2025 also introduces new attachments, namely Attachments L, M, N, and O.

Transitional Provisions

The DGT emphasized that upon the enforcement of PER-4/PJ/2025, previously issued documents — including the Tax Due Notification Letter (SPPT), L&B Tax Assessment Letter (SKP PBB), L&B Overpayment Decision Letter (SKKP PBB), Notification Letter (SPb), and L&B Tax Billing Letter (STP PBB) — shall remain valid. (ASP/SYF/KEN)