Get Ready to File: MUC and PayrollQ Webinar on Individual Annual Tax Returns

JAKARTA. MUC Consulting, along with PayrollQ and Pajak.com, held another joint webinar, this time addressing the topic of calculating and filing individual annual income tax returns (SPT).

This event is highly relevant to taxpayers, who are currently facing the deadline for filing their 2024 individual annual tax returns, which falls on March 31, 2025.

The webinar, held on Wednesday (March 12), was attended by over 100 participants online via Zoom. The session was presented by Dwi Novianti Suharsih, Tax Compliance Supervisor at MUC Consulting.

Webinar Material

In her presentation, Dwi shared several points related to the calculation and filing of individual annual income tax returns (SPT).

First, she explained the legal basis that serves as a reference for fulfilling tax obligations.

Second, she discussed who is required to file individual annual tax returns each year, emphasizing that only taxpayers who possess a Taxpayer Identification Number (TIN) are obligated to submit individual income tax returns.

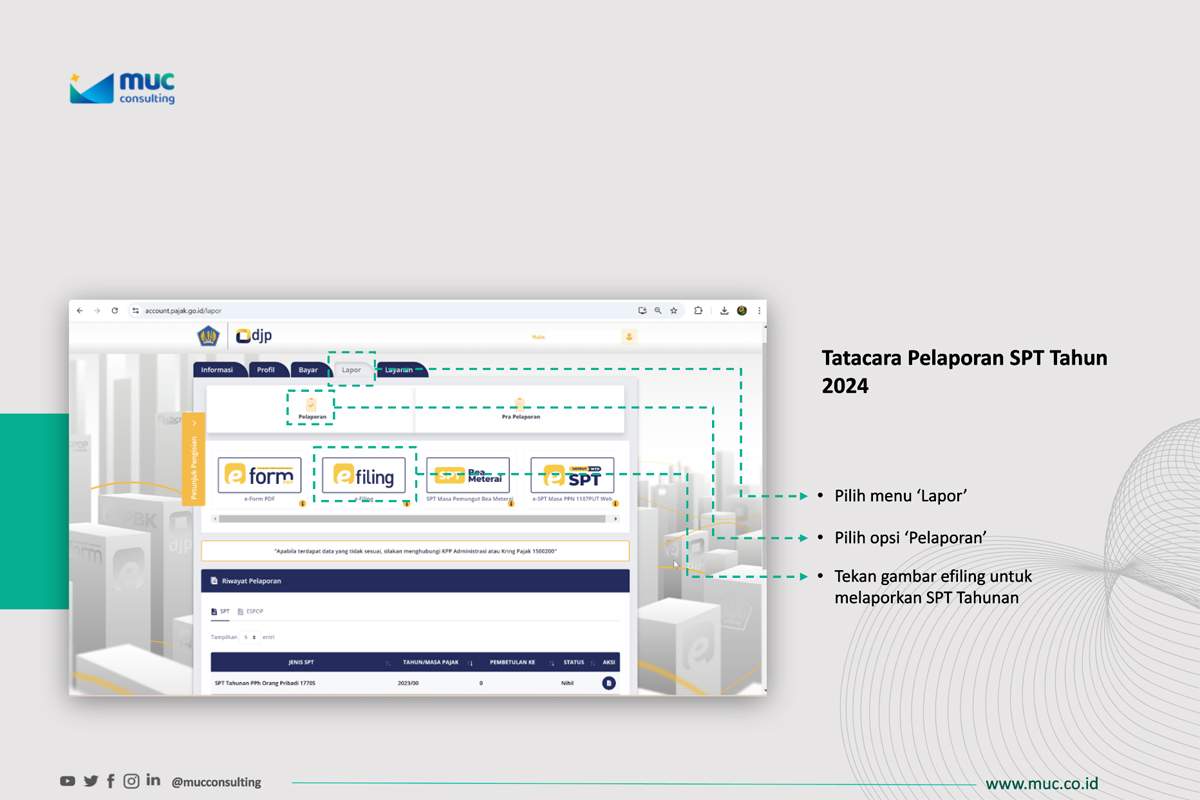

Third, Dwi provided a step-by-step guide on how to file individual annual tax returns through an activated DGT Online account.

Read more: DGT Officially Waives Penalties for Late Tax Payments and Filing Due to Coretax

Steps for Filing the Annual Tax Return

Through this guide, participants received a step-by-step explanation on how to file their annual tax return (SPT), starting from logging in to the DGT Online portal, downloading withholding tax slips for Income Tax Article (ITA) 21 and unification of income tax, identifying the appropriate individual SPT form to use, and completing the annual tax return using e-filing.

The procedure for filling out the SPT form via e-filing was explained in considerable detail. This included how to add new withholding tax slips and questions related to the taxpayer’s income. Additionally, instructions on how to complete the assets and liabilities (debts) sections were also provided.

The webinar concluded with a Q&A session, where participants asked questions directly. Through this event, it is expected that participants will be able to fulfill their tax obligations properly, accurately, and on time. (ASP/KEN)