Implementation of IIR as a Charging Mechanism in the Global Minimum Tax under PMK 136/2024

The implementation of the global minimum tax, or Global Anti-Base Erosion (GloBE), at a rate of 15% under the Minister of Finance Regulation (PMK) Number 136 of 2024 (136/2024), triggers the imposition of an additional tax, known as the top-up tax.

There are several types of charging mechanisms for the top-up tax under PMK 136/2024, one of which is the Income Inclusion Rules (IIR). The IIR aims to prevent base erosion and profit shifting while safeguarding Indonesia’s taxing rights.

The IIR provisions are designed to ensure that an additional tax is imposed on domestic taxpayers serving as parent entities when other constituent entities within a Multinational Enterprise (MNE) Group—owned directly or indirectly—are subject to an effective tax rate below 15%.

The applicable IIR must meet certain qualifications, referred to as a qualified IIR. A qualified IIR is a domestic law provision in a country or jurisdiction whose implementation and administration align with the GloBE rules.

Read: Indonesia to Officially Implement Global Minimum Tax Starting 1 January 2025

Parties Subject to IIR Allocation

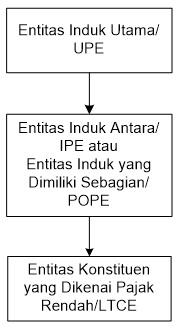

The IIR top-up tax is allocated from low-taxed constituent entities (LTCE) to domestic taxpayers, which are constituent entities of the MNE Group.

Constituent entities subject to IIR allocation consist of:

- Ultimate Parent Entity (UPE);

- Intermediate Parent Entity (IPE); and/or

- Partially-Owned Parent Entity (POPE)

IIR Exemption for Intermediate Parent Entities

If the country or jurisdiction of the ultimate parent entity applies a qualified IIR, the top-up tax is imposed on the ultimate parent entity.

If this condition is met, the imposition of IIR on the intermediate parent entity is exempted.

The imposition of IIR on the intermediate parent entity is also exempted if there is an intermediate parent entity, directly or indirectly controlling, in a country/jurisdiction that applies a qualified IIR.

Read: Understanding DMTT, The GloBE Rules’ Additional Tax That Benefits Indonesia

IIR for Partially-Owned Parent Entities

Meanwhile, a partially owned parent entity is not subject to IIR, as long as the partially owned parent entity is wholly owned, either directly or indirectly, by another partially owned parent entity in a country or jurisdiction with a qualified IIR.

Based on the explanation above, the mechanism for imposing IIR can be illustrated as follows:

The IIR is imposed using a top-down approach based on the above scheme with the following provisions:

- If the jurisdiction of the ultimate parent entity applies the GloBE rules/qualified IIR, the ultimate parent entity is subject to IIR allocation.

- If the jurisdiction of the ultimate parent entity does not apply the GloBE rules/qualified IIR, but the jurisdiction of the intermediate parent entity does, the intermediate parent entity is subject to IIR allocation.

- If both the jurisdiction of the ultimate parent entity and the intermediate parent entity apply the GloBE rules/qualified IIR, the ultimate parent entity is subject to IIR allocation.

Read: PMK 136/2024: Safe Harbour Provisions in the Transitional Period of GloBE Rules

Basis for Calculating IIR Allocation

The IIR allocated to the parent entity is the result of multiplying the top-up tax from the low-taxed constituent entity by the parent entity’s inclusion ratio over that constituent entity for a fiscal year.

The parent entity’s inclusion ratio is the ratio between the low-taxed constituent entity’s GloBE income for that fiscal year, minus the amount of GloBE income attributed to the ownership interests of other owners and the low-taxed constituent entity’s GloBE income for the same fiscal year.

The GloBE income referred to does not include income from a Flow-through Entity (FTE) allocated to owners outside the group. For further clarification, consider the following example.

Group A (MNE) owns several entities, including one FTE within the group that generates income and allocates that income to its owners.

Entity C is a subsidiary of Group A and an FTE used to transfer profits to its owners. Entity C is owned by Entity XYZ and Entity ABC.

Entity XYZ (Owner of Entity C) receives the income allocation from the FTE, but since Entity XYZ is not part of the group, the income allocated to it is not counted in Group A’s global tax calculation for GloBE purposes.

Meanwhile, Entity ABC (Owner of Entity C) is an entity within the group, so the income allocated to it is counted as part of Group A’s income.

Read: Government Introduces 5 Relaxations for First Year of Global Minimum Tax

GloBE Income Attributed to Other Ownership Interests

The amount of GloBE income attributed to other ownership interests is calculated based on financial accounting standards that are acceptable and used in the ultimate parent entity’s consolidated financial statements, with the following provisions:

- The parent entity has prepared consolidated financial statements under the accounting standards used by the ultimate parent entity or hypothetical consolidated financial statements.

- The parent entity has a controlling interest in the low-taxed constituent entity.

- All GloBE income of the low-taxed constituent entity is attributed to transactions with parties outside the group.

- All ownership interests are not directly or indirectly owned by the parent entity through parties outside the group.

Reduction of Top-up Tax Portion

A parent entity with an indirect ownership interest in a low-taxed constituent entity through an intermediate parent entity or a partially owned parent entity must reduce the portion of the top-up tax under the IIR allocated to the parent entity.

This provision applies if the intermediate parent entity or the partially-owned parent entity does not meet the IIR exemption requirements.

Portion of Top-up Tax Deducted

The portion of the top-up tax deducted refers to the top-up tax under the IIR imposed on the intermediate parent entity or the partially-owned parent entity in accordance with the qualified IIR. This mechanism aims to avoid double taxation within the MNE group.

Examples of IIR calculation, IIR top-up tax allocation, and the mechanism for reducing the portion of the top-up tax under the IIR are provided in the appendix, which forms an integral part of PMK 136/2024.

Tax Return Filing

Under PMK 136/2024, the obligation to report the top-up tax under the IIR involves several key steps for MNE groups registered in Indonesia.

Every ultimate parent entity that is a domestic taxpayer and permanent establishment is required to submit an Annual Income Tax Return (SPT) for GloBE, which includes the calculation of the top-up tax under the IIR if the foreign tax paid is lower than the stipulated minimum tax.

In addition, the ultimate parent entity must submit a Global Income Report (GIR) to the Director General of Taxes no later than 15 months after the end of the fiscal year, except for the first year, in which the GIR must be submitted no later than 18 months after the end of the fiscal year.

The GIR includes information on the effective tax rate, the top-up tax paid by each entity within the group, and the allocation of the top-up tax under the IIR. Constituent entities in Indonesia that have submitted the GIR are not required to submit a Notification.

The top-up tax payable under the IIR must be paid in the fiscal year following the GloBE imposition year in Indonesian Rupiah.

Thus, the IIR top-up tax reporting process includes completing the Annual GloBE Income Tax Return (SPT), submitting the GIR, filing the SPT related to top-up tax allocation, and fulfilling the tax payment obligation within the stipulated timeframe.

Example of IIR Implementation

Below is an example of IIR implementation following PMK Number 136 of 2024:

X Co is domiciled in Country X and serves as the Ultimate Parent Entity (UPE) of the XYZ Group, which is a Multinational Enterprise (MNE) Group. X Co directly owns Y Co, which is domiciled in Country Y.

Y Co directly owns Z Co, which is domiciled in Country Z. Both Country X and Country Y apply the GloBE rules/qualified IIR, while Z Co does not apply the GloBE rules and is located in a low-tax jurisdiction (low-taxed constituent entity/LTCE).

X Co and Y Co have effective tax rates above the minimum rate (above 15%), but Z Co is a constituent entity subject to low taxation in a low-tax jurisdiction. Below is the structural diagram of the XYZ Group.

Based on the above scheme, X Co, as the ultimate parent entity, has priority in applying the IIR under Article 14, considering that Country X implements the GloBE rules/qualified IIR. In this case, even though Country Y also applies the GloBE rules, the IIR allocation remains imposed on X Co following the top-down approach.

If the top-up tax allocated from Z Co amounts to EUR 15,000,000.00, the IIR application based on the top-down approach is imposed on the ultimate parent entity, X Co, amounting to EUR 15,000,000.00 (100% x EUR 15,000,000.00).

For more information, please contact the Transfer Pricing Division of MUC Consulting at ask_muc@muc.co.id. The Transfer Pricing Division of MUC Consulting is supported by professionals with extensive experience in handling transfer pricing disputes and has received recognition from various professional organizations, including the Certificate of Professional Training in Fundamentals of GloBE Rules - Pillar Two. This certificate was awarded for participation in training related to GloBE rules from IBFD.