Understanding UTPR in PMK 136/2024: A Proportional Additional Tax Mechanism

The issuance of Minister of Finance Regulation (PMK) 136 of 2024 (PMK 136/2024) reaffirms Indonesia's position in the global agenda to combat tax avoidance practices, particularly in income taxation.

Effective January 1, 2025, the regulation establishes the mechanism for imposing the Global Minimum Tax (Global Anti-Base Erosion Rules/GloBE) at a rate of 15% on multinational enterprises (MNEs).

The implementation of the global minimum tax follows three complementary Top-Up Tax mechanisms: the Income Inclusion Rule (IIR), the Undertaxed Payment Rule (UTPR), and/or the Domestic Minimum Top-Up Tax (DMTT).

Read: Indonesia to Officially Implement Global Minimum Tax Starting 1 January 2025

The Income Inclusion Rule (IIR) is an additional tax provision applied by the country/jurisdiction where the parent entity is located if another entity within the MNE Group pays tax below the minimum rate (below 15%).

Meanwhile, the Undertaxed Payment Rule (UTPR) is an additional tax provision applied if the country where the parent entity is located does not apply IIR and/or the additional tax has not been fully imposed.

The Domestic Minimum Top-Up Tax (DMTT) is an additional tax provision for domestic taxpayers who are Constituent Entities of an MNE Group if the effective tax rate paid is below 15%.

This article will specifically review the implementation mechanism of the UTPR, from the concept to the calculation process, following PMK 136/2024.

Understanding the UTPR Mechanism

The Undertaxed Payment Rule (UTPR) is one of the key aspects of this regulation. As previously mentioned, the UTPR mechanism is applied if the country/jurisdiction where the parent entity is located does not implement the Income Inclusion Rule (IIR).

With the UTPR mechanism, the Top-Up Tax will be fairly distributed among the countries where the entities within the group operate, including permanent establishments of the main entity. However, investment entities are excluded from this distribution.

The distribution of additional tax through the UTPR is based on the economic contribution of each country, which is calculated from the number of employees and the value of tangible assets in each country. This approach ensures that countries contributing significantly to the company's economic activity receive a proportional share of the tax.

How to Calculate UTPR Additional Tax

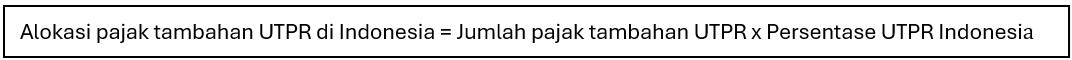

The additional tax allocated to Indonesia under UTPR is the result of multiplying the total additional tax by Indonesia's UTPR percentage, which can be formulated as follows:

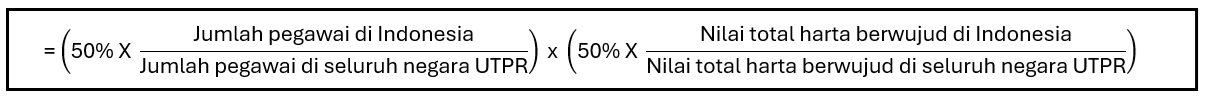

The UTPR percentage is determined each tax year using the following formula:

- 50% of the ratio of the number of employees in Indonesia to the total number of employees in all countries within the MNE Group that apply UTPR.

- 50% of the ratio of the value of tangible assets in Indonesia to the total value of tangible assets in all countries within the MNE Group that apply UTPR.

This can also be expressed as:

Factors Considered

Several factors must be considered in this calculation. First, the number of employees includes both permanent employees and independent contractors actively involved in the company's routine operations.

Meanwhile, tangible assets include fixed assets but exclude cash or cash equivalents, intangible assets, and financial assets.

If a flow-through entity operates through a permanent establishment, the number of employees and the net book value of tangible assets must be allocated to that permanent establishment. The number of employees and net book value of tangible assets that are not allocated according to the rules will be excluded from the calculation.

Example of Calculating UTPR Additional Tax

Assume that for the 2026 tax year, the HANA Group meets the GloBE threshold because the gross revenue in the consolidated financial report for the 2022 and 2025 tax years exceeds EUR 750 million.

Here is the financial information from the HANA Group for the 2026 tax year:

|

Financial Information |

A Ltd |

B Co |

PT C |

D S.A. |

|

GloBE profit |

2.000 |

2.000 |

2.000 |

2.000 |

|

Adjusted Covered Taxes |

500 |

100 |

400 |

500 |

|

Qualifying Tangible Assets |

|

1.000 |

1.600 |

1.000 |

|

Qualifying Payroll Costs |

|

2.000 |

3.000 |

2.000 |

Additionally, here is other relevant information:

|

Description |

A Ltd |

B Co |

PT C |

D S.A. |

|

Effective Tax Rate |

25% |

5% |

20% |

25% |

|

Number of Employees |

|

|

30 |

20 |

Since B Co's effective tax rate is below 15%, its income will be subject to additional tax, calculated as follows:

- Additional Tax Percentage:

= Minimum rate – Effective tax rate

= 15% – 5%

= 10%

- Excess Profit Calculation:

= GloBE Profit - SBIE

= Globe Profit ((certain percentage × qualifying payroll)+ (certain percentage × qualifying tangible assets))

= EUR 2.000 – ((9,4% x EUR 2.000) + (7,4% x EUR 1.000))

= EUR 2.000 – EUR 262

= EUR 1.738,00

- Additional Tax:

= 10% x EUR 1.738,00

= EUR 173,80

Since A Ltd, the Parent Entity, is located in Country A and does not apply DMTT or IIR, the additional tax on B Co will be allocated to the other countries within the HANA Group that apply UTPR, which are Indonesia and Country D. Here’s the allocation for each:

- Allocation of UTPR Additional Tax to Indonesia:

= Total Additional Tax × UTPR Percentage in Indonesia

= EUR 173.80 × ((50% × 30/50) × (50% × 1,600/2,600))

= EUR 173.80 × 61%

= EUR 105.61

- Allocation of UTPR Additional Tax to Country D:

= Total Additional Tax × UTPR Percentage in Country D

= EUR 173.80 × ((50% × 20/50) × (50% × 1,000/2,600))

= EUR 173.80 × 39%

= EUR 68.18

Reporting of UTPR Additional Tax

According to Article 73 of PMK 136/2024, if there is an allocation of additional tax based on UTPR to Indonesia, domestic taxpayers and permanent establishments that are part of a multinational group (PMN) are required to submit an Annual Tax Return for UTPR Income Tax.

The UTPR Annual Income Tax Return Form must be submitted to the Tax Office (KPP) where the taxpayer is registered, or to another location determined by the Directorate General of Taxes (DGT).

However, as of now, we are still awaiting further regulations from the DGT regarding the form, filling procedures, payment procedures, and the reporting process for the UTPR Income Tax Annual Return.

With this regulation, Indonesia has a great opportunity to receive its fair share of global additional tax. This step also proves that Indonesia is actively participating in the global collaboration against tax avoidance practices.

Therefore, transparent, data-driven allocation and strengthening the national taxation system are essential to ensure that the UTPR additional tax mechanism is applied fairly and proportionally.

For more information, please contact the Transfer Pricing Division of MUC Consulting at ask_muc@muc.co.id. The Transfer Pricing Division of MUC Consulting is supported by professionals with extensive experience in handling transfer pricing disputes and has received recognition from various professional organizations, including the Certificate of Professional Training in Fundamentals of GloBE Rules - Pillar Two. This certificate was awarded for participation in training related to GloBE rules from IBFD.