Understanding DMTT, The GloBE Rules’ Additional Tax That Benefits Indonesia

The Indonesian government has officially implemented the Global Anti-Base Erosion (GloBE) Rules or the 15% Global Minimum Tax through the Minister of Finance Regulation (PMK) 136 of 2024.

By ratifying this global consensus, the government has the opportunity to gain additional revenue from the extra tax imposed under these rules. In general, there are three mechanisms for the imposition of the additional tax: the Income Inclusion Rule (IIR), the Undertaxed Payment Rule (UTPR), and the Domestic Minimum Top-up Tax (DMTT).

Among these mechanisms, DMTT has the greatest potential to increase Indonesia’s tax revenue. This is because DMTT is imposed by a country/jurisdiction on constituent entities of multinational enterprise (MNE) groups operating in Indonesia with an effective tax rate of less than 15%.

Meanwhile, IIR is applied by the country/jurisdiction where the parent entity is located, and UTPR can be enforced if IIR is not applied in any country/jurisdiction.

To understand the details of the DMTT calculation and its implementation, we will explore it further in this article, as regulated in Chapter XI of PMK 136/2024.

Read: Understanding UTPR in PMK 136/2024: A Proportional Additional Tax Mechanism

Concept and Implementation of DMTT

DMTT is imposed on constituent entities in Indonesia, whether partially or wholly owned by other entities within an MNE group that meets the GloBE Rules threshold. This additional tax is applied without considering the inclusion ratio.

However, DMTT can only be imposed by a country/jurisdiction that has adopted DMTT provisions aligned with the GloBE Rules, known as Qualified DMTT (QDMTT).

The calculation of this additional tax is done by multiplying the top-up tax percentage by the excess profit and then adding the Additional Current Top-Up Tax.

Read Also: PMK 136/2024: Safe Harbour Provisions in the Transitional Period of GloBE Rules

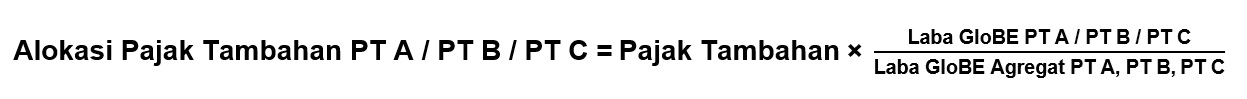

Next, the additional tax is allocated to constituent entities in Indonesia that have an Effective Tax Rate below 15%. The allocation is determined by multiplying the DMTT-based top-up tax by each entity’s GloBE income, divided by the aggregate GloBE income of all constituent entities in Indonesia.

For illustration, consider three constituent entities—PT A, PT B, and PT C—each with an Effective Tax Rate below 15%. The allocation calculation can be formulated as follows.

It is important to note that the calculation of additional tax under DMTT is done separately for minority-owned constituent entities, investment entities, and joint venture groups.

For a better understanding, below is a simple example of how to calculate the additional tax under DMTT.

Example of DMTT Calculation and Its Interaction with IIR

Example 1:

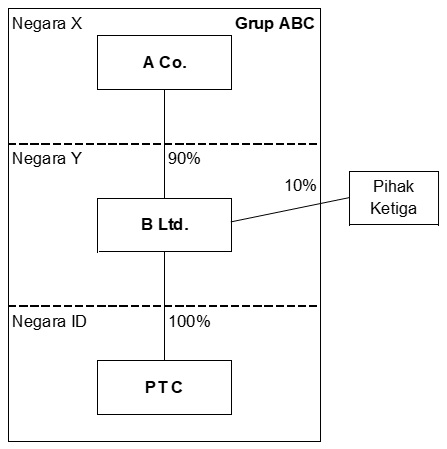

A Co. is the Ultimate Parent Entity (UPE) of the ABC MNE Group, located in Country X. A Co. owns 90% of B Ltd., which is based in Country Y, while the remaining 10% is owned by an entity outside the ABC MNE Group. B Ltd. fully owns PT C, which is located in Country ID.

Country X and Country Y have implemented the GloBE Rules, whereas Country ID has not adopted them and is considered a low-tax jurisdiction.

PT C has an Effective Tax Rate (ETR) of 12% and an excess profit of EUR 1,500. Based on the IIR calculation, the additional tax is EUR 40.5 [(15%-10%) x 90% x EUR1.500 = EUR40,5].

Since Country X has implemented a Qualified IIR, the additional tax of EUR 40.5 is imposed in Country X, where A Co. is located. Even though B Ltd. fully owns PT C, Country Y cannot apply the IIR because B Ltd. is not a Partially-Owned Parent Entity (POPE)—its ownership by entities outside the ABC MNE Group is less than 20%.

However, if Country ID had implemented the GloBE Rules and DMTT, the additional tax under DMTT would be calculated without considering the inclusion ratio. In this case, the additional tax in Country ID for PT C would be EUR 45 [(15%-10%) x EUR1.500 = EUR45].

Example 2:

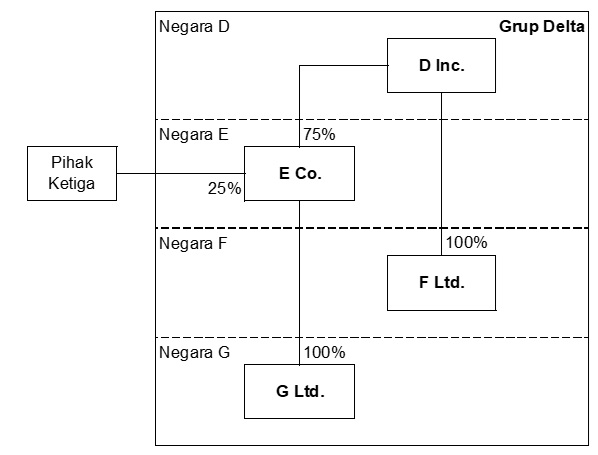

D Inc., located in Country D, is the Ultimate Parent Entity of the Delta MNE Group. D Inc. owns 75% of E Co., which is located in Country E, while the remaining 25% is minority-owned by an entity outside the Delta MNE Group. E Co. fully owns G Ltd., which is located in Country G. In addition, D Inc. also fully owns F Ltd., which is located in Country F.

Country D applies IIR and UTPR, Country E does not implement the GloBE Rules, Country F applies IIR and UTPR, and Country G does not implement the GloBE Rules and is a low-tax jurisdiction.

It is known that G Ltd. has an income of EUR 500. G Ltd. pays a tax of EUR 55 in Country G on its income. Assuming there is no SBIE for G Ltd., the calculation of the Effective Tax Rate and additional tax for G Ltd. is as follows:

Effective Tax Rate = 11% (EUR 55 / EUR 500)

Top-Up Tax Percentage = 4% (15% - 11%)

Additional Tax = EUR 20 (4% × EUR 500)

The additional tax will be imposed on D Inc. as the Ultimate Parent Entity in Country D because it has implemented IIR. The additional tax is imposed by calculating D Inc.'s inclusion ratio/ownership share in G Ltd., so the additional tax under IIR is EUR 15 (75% × 4% × EUR 500).

Meanwhile, if Country G implements the GloBE Rules and DMTT, the additional tax can be imposed in Country G on G Ltd. without considering the inclusion ratio, which amounts to EUR 20.

Read: Government Introduces 5 Relaxations for First Year of Global Minimum Tax

Example Calculation of DMTT, IIR, and UTPR

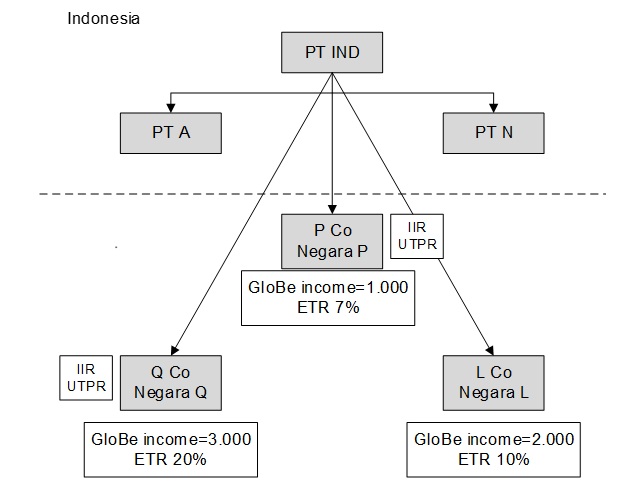

PT IND is the Ultimate Parent Entity of an MNE Group subject to the GloBE Rules and is located in Indonesia. This MNE Group has several Constituent Entities spread across different countries.

In Indonesia, PT IND owns two Constituent Entities: PT A and PT N. Additionally, PT IND directly owns three other Constituent Entities: P Co in Country P, Q Co in Country Q, and L Co in Country L.

It is known that Countries P and Q have adopted the IIR, DMTT, and UTPR rules. The ownership structure of this MNE Group can be illustrated in an ownership chart.

Below is the financial information of PT IND, PT A, and PT N for the year 2025:

|

|

PT IND (in EUR) |

PT A (in EUR) |

PT N (in EUR) |

Total (in EUR) |

|

Profit |

1.000 |

500 |

500 |

2.000 |

|

Taxes Paid |

50 |

0 |

100 |

150 |

|

Effective Tax Rate |

5% |

0% |

20% |

7,5% |

|

Tangible Assets |

250 |

50 |

100 |

400 |

|

Payroll Costs |

400 |

200 |

400 |

1.000 |

If Indonesia implements DMTT in 2025, the additional tax calculation under DMTT in Indonesia is as follows:

Effective Tax Rate = EUR 150.00 / EUR 2,000.00 = 7.5%

Top-Up Tax Percentage = 15% - 7.5% = 7.5%

SBIE Calculation = (9.6% × EUR 1,000.00) + (7.6% × EUR 400.00) = EUR 126.40

Excess Profit = GloBE Profit - SBIE = EUR 2,000 - EUR 126.40 = EUR 1,873.60

Additional Tax (DMTT) = 7.5% × EUR 1,873.60 = EUR 140.520

Article 53(3) and (4) state that the additional tax under DMTT must be paid by PT IND and PT A, which have an effective tax rate of <15%, calculated as follows:

PT IND = EUR 140.520 × (EUR 1,000.00 / EUR 1,500.00) = EUR 93.680

PT A = EUR 140.520 × (EUR 500.00 / EUR 1,500.00) = EUR 46.840

Below is the financial information of P Co, Q Co, and L Co:

|

Country |

Constituent Entity |

GloBE Profit (in EUR) |

Effective Tax Rate (in EUR) |

|

Negara P |

P Co |

1.000 |

7% |

|

Negara Q |

Q Co |

2.000 |

20% |

|

Negara L |

L Co |

3.000 |

10% |

The assumed number of employees in Country Q is 200 people, and the number of employees in Country P is 50 people. The value of tangible assets in Country Q is EUR450.00, and the value of tangible assets in Country P is EUR50.00.

Given that P Co is subject to an effective tax rate of <15% and Country P applies DMTT, P Co's income will be subject to additional DMTT tax in Country P, calculated as follows:

Effective Tax Rate = 7%

Top-up Tax Percentage = 15% - 7% = 8%

Excess Profit = EUR1,000.00 (assuming SBIE in Country P is 0)

Additional Tax under DMTT in Country P = 8% × EUR1,000.00 = EUR80.00

Besides P Co, another Constituent Entity in the PMN Group subject to an effective tax rate of <15% is L Co, which is located in Country L.

Assuming Country L has not implemented DMTT in 2025, L Co's income may be subject to additional tax under IIR in Indonesia, calculated as follows:

Effective Tax Rate = 10%

Top-up Tax Percentage = 15% - 10% = 5%

Excess Profit = EUR2,000.00 (assuming SBIE in Country L is 0)

Additional Tax under IIR in Indonesia = 5% × EUR2,000.00 = EUR100.00

The additional tax under IIR in Indonesia is allocated to each Constituent Entity in Indonesia as follows:

- PT IND = EUR100.00 × (EUR1,000.00 / EUR2,000.00) = EUR50.00

- PT A = EUR100.00 × (EUR500.00 / EUR2,000.00) = EUR25.00

- PT N = EUR100.00 × (EUR500.00 / EUR2,000.00) = EUR25.00

If Indonesia does not implement IIR and DMTT in 2025, and given that the Effective Tax Rate is less than 15%, the Parent Entity's income in Indonesia will be subject to additional tax under UTPR in the countries of the other Constituent Entities that apply UTPR, namely Country Q and Country P.

The allocation of additional tax under UTPR is as follows:

Additional Tax in Indonesia = EUR140.52

UTPR Allocation Percentage in Country Q = 50% (200/250) + 50% (EUR450.00/EUR500.00) = 85%

Additional Tax under UTPR allocated to Country Q = EUR119.44 (85% × EUR140.52)

UTPR Allocation Percentage in Country P = 50% (50/250) + 50% (EUR50.00/EUR500.00) = 15%

Additional Tax under UTPR allocated to Country P = EUR21.08 (15% × EUR140.52)

Conclusion

The implementation of DMTT, as regulated in PMK 136/2024, demonstrates Indonesia's commitment to adopting Pillar 2 of the GloBE Rules. The purpose of implementing the GloBE Rules is to reduce tax base erosion and profit shifting by MNE Groups, as well as to prevent the "race to the bottom" in tax rates across various international jurisdictions.

With a detailed calculation mechanism, DMTT ensures that Constituent Entities with an Effective Tax Rate (ETR) below 15% are fairly subject to additional taxation, whether through DMTT, IIR, or UTPR.

For more information, please contact the Transfer Pricing Division of MUC Consulting at ask_muc@muc.co.id. The Transfer Pricing Division of MUC Consulting is supported by professionals with extensive experience in handling transfer pricing disputes and has received recognition from various professional organizations, including the Certificate of Professional Training in Fundamentals of GloBE Rules - Pillar Two. This certificate was awarded for participation in training related to GloBE rules from IBFD.