Breaking Down Tax Compliance Strategies in Construction with MUC Consulting and Aspeknas

JAKARTA – Tax compliance in the construction services sector is a crucial aspect that business actors must pay close attention to. To provide a better understanding of effective strategies for fulfilling tax obligations, MUC Consulting, in collaboration with the National Construction Association Executive (Aspeknas), held a webinar titled “Tax Compliance Strategies for Construction Services: Optimizing Rates and Reporting in Line with the Latest Regulations.” The webinar took place on March 18, 2025, featuring Shinta Marvianti, Tax Dispute Partner at MUC Consulting, and Cindy Miranti, Tax Advisory Manager at MUC Consulting, as speakers.

Opening the session, Dr.(cand.) Ir. Fandy Iood, ST., M.PWK., IPM, Chairman of APPEKNAS, highlighted the importance of understanding tax regulations for construction entrepreneurs to minimize non-compliance risks and enhance financial efficiency. Meanwhile, in her keynote speech, Shinta Marvianti emphasized the essential role of taxes in supporting infrastructure development.

“The taxes paid by the public are used to build various public facilities such as roads, schools, hospitals, and other infrastructure that supports national progress. Therefore, active participation in fulfilling tax obligations is extremely important,” explained Shinta.

She also stressed that one of the key challenges in tax administration is the lack of public awareness regarding the importance of taxes. For this reason, she emphasized the need to continue educating the public on the benefits of taxation to raise awareness and improve compliance.

“Many people are reluctant or do not fully understand how taxes contribute to national development. That’s why it’s important to keep educating the public about the benefits of taxation to enhance awareness and compliance with tax obligations,” she added.

Tax Regulations for Construction Services

In her presentation, Cindy Miranti, Tax Advisory Manager at MUC Consulting, provided a comprehensive explanation of tax implementation in construction service transactions, particularly Income Tax Article (ITA) 23 and Final Income Tax. She emphasized that there are distinct differences between Final and Non-Final Income Tax (ITA 23)—not only in terms of withholding mechanisms but also in their long-term implications for a company's tax obligations.

Cindy explained that Final Income Tax is conclusive at the time of withholding. This means that once the tax is withheld and paid, the tax obligation on that income is considered fulfilled. This scheme is commonly applied to income derived from construction services, which are subject to specific rates depending on business classification and company qualification.

On the other hand, Non-Final Income Tax (ITA 23) operates differently. The withheld tax is not the final settlement, but rather serves as a tax credit that can be deducted from the total payable tax when the taxpayer files their annual tax return (SPT).

“So the tax withheld under ITA 23 serves only as a credit, which can later be offset against the total tax due when the annual return is filed,” she explained.

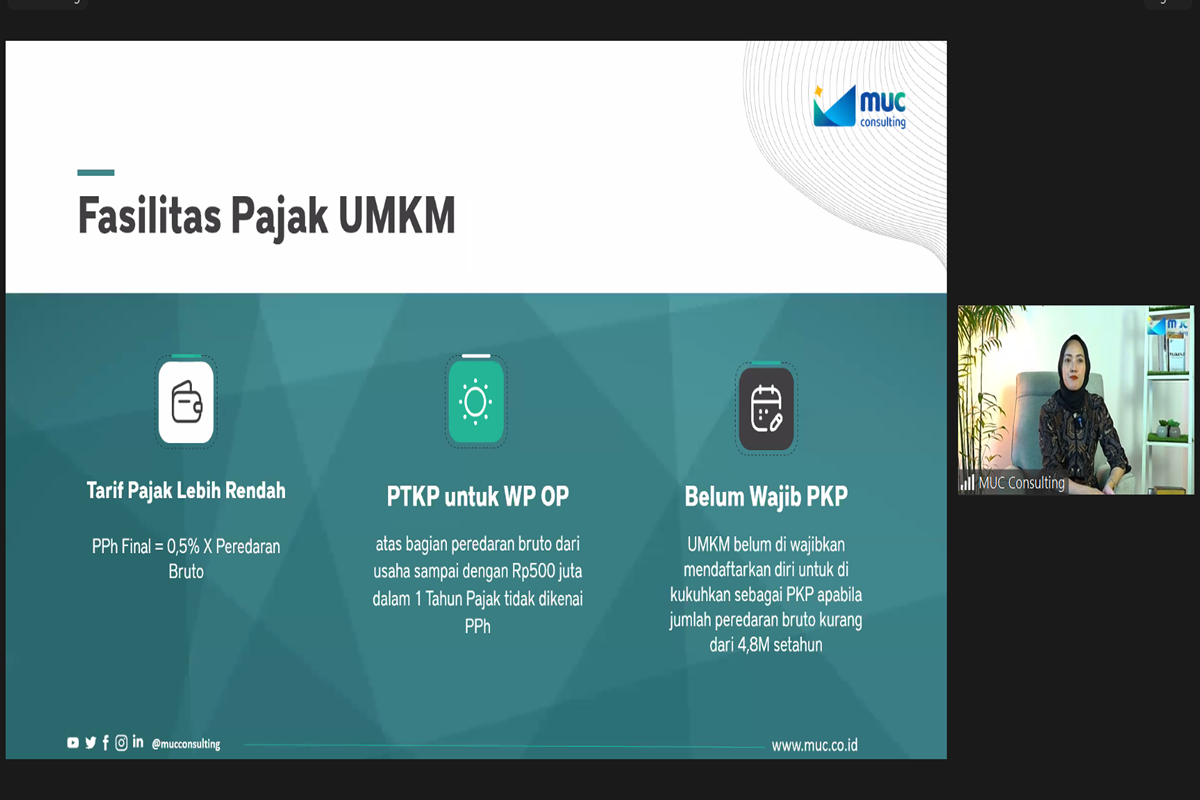

Cindy also discussed the Final Income Tax facility for MSMEs, which offers a lighter tax burden for small-scale businesses. This topic attracted considerable attention from participants, considering the construction sector involves businesses of all sizes—from large contractors to small and medium-scale service providers.

With a better understanding of the applicable tax regulations, business actors in the construction services sector can optimize their tax management, reduce the risk of non-compliance, and make the most of the available tax facilities. (KEN)