Three Factors Behind the 30% Drop in Tax Revenue in January–February 2025

JAKARTA – Tax revenue for the period of January–February 2025 amounted to only IDR 187.8 trillion, marking a 30.19% decline compared to the same period in 2024, which reached IDR 269.02 trillion.

This decline comes despite the government setting a relatively ambitious tax revenue target for 2025 at IDR 2,189.3 trillion, a 13.29% increase from total tax revenue realized in 2024.

Nevertheless, the government remains optimistic that tax revenue performance will improve in the coming months. It attributes the sharp drop in early 2025 partly to administrative factors.

Key Factors Behind the Decline

1. Decline in Commodity Prices

Deputy Minister of Finance Anggito Abimanyu pointed to falling prices of key commodities, including coal (-11.8%), Brent crude oil (-5.2%), and nickel (-5.9%).

These price drops directly impacted Income Tax Article (ITA) 25 receipts and tax revenue from the mining sector as a whole.

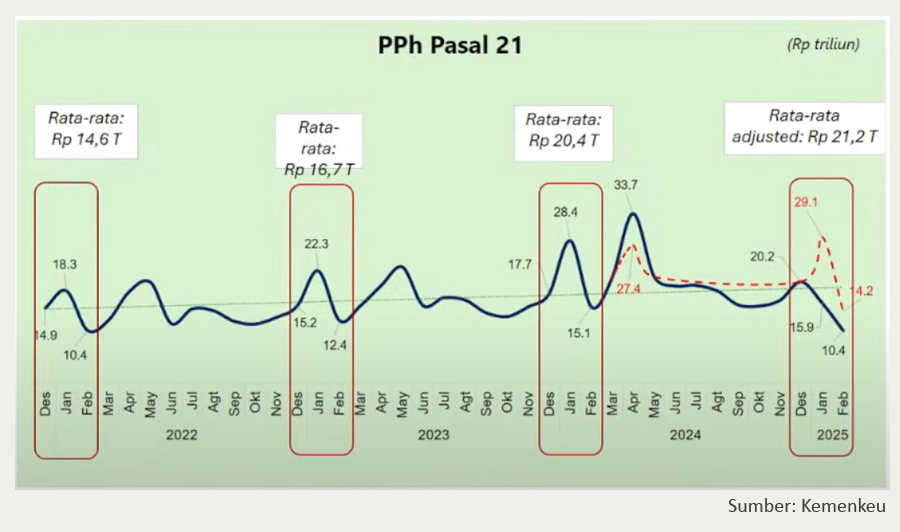

2. Impact of ITA 21 TER Mechanism

The implementation of the new withholding mechanism for Income Tax Article (ITA) 21 in January 2024 resulted in overpayments, which were claimed in the January and February 2025 tax periods.

The total ITA 21 overpayments reimbursed by the tax authority reached IDR 16.5 trillion, contributing to the decline in ITA 21 revenue during the first two months of 2025.

3. Sanction Relief for Late VAT Payments

The government also attributed the drop in revenue to the relaxation of sanctions for late payment of Domestic Value Added Tax (VAT), extended until March 10, 2025.

This policy was outlined in the Director General of Taxes Decree No. KEP-67/PJ/2025, issued to accommodate taxpayers facing difficulties in filing and paying taxes due to Coretax system issues.

Despite these temporary setbacks, the government is confident that tax revenue will rebound as these administrative issues are resolved and the economy stabilizes.

Still Within Normal Range

Further commenting on the situation, Anggito stated that the trend in tax revenue for January and February 2025 did not indicate any anomalies.

According to him, the overall pattern remains consistent with previous years, where tax revenue typically peaks in December and then declines in January and February.

“It’s the same every year—there’s nothing anomalous about it,” he said.

Even though there was a nominal decline compared to January and February 2024, he emphasized that it was largely due to the three factors previously mentioned. (ASP/KEN)