How to Merge the Tax ID Numbers (TIN) of Husband and Wife Through the Coretax System

For a married woman who earns income from her employment, there are two options in fulfilling her tax obligations. First, using a joint Tax ID Number (TIN) with her husband.

Second, continuing to fulfill her tax obligations using a TIN separate from her husband. This means that each spouse maintains their own TIN. This can be done if the husband and wife have a prenuptial agreement on separation of assets (PH) or if the wife chooses to fulfill her tax obligations separately (MT).

Each choice carries different tax consequences. However, by merging the TINs of husband and wife, taxpayers can avoid the risk of overpayment of tax payable when submitting the annual income tax return (SPT).

In addition, by merging the wife’s TIN with the husband’s TIN, the wife will no longer be required to submit an annual income tax return. Only the husband will file it, but he must still report the amount of withholding income tax already deducted by the wife’s employer in his return.

This article explains the procedure for merging the wife’s TIN with the husband’s TIN, based on the applicable provisions in the Coretax tax administration system. In general, there are two main stages in the process of merging husband-and-wife TINs. First, the process of deactivating the wife’s TIN. Second, the process of adding the wife to the husband’s Coretax account.

1. Process of Deactivating the Wife’s Tax ID Number (TIN)

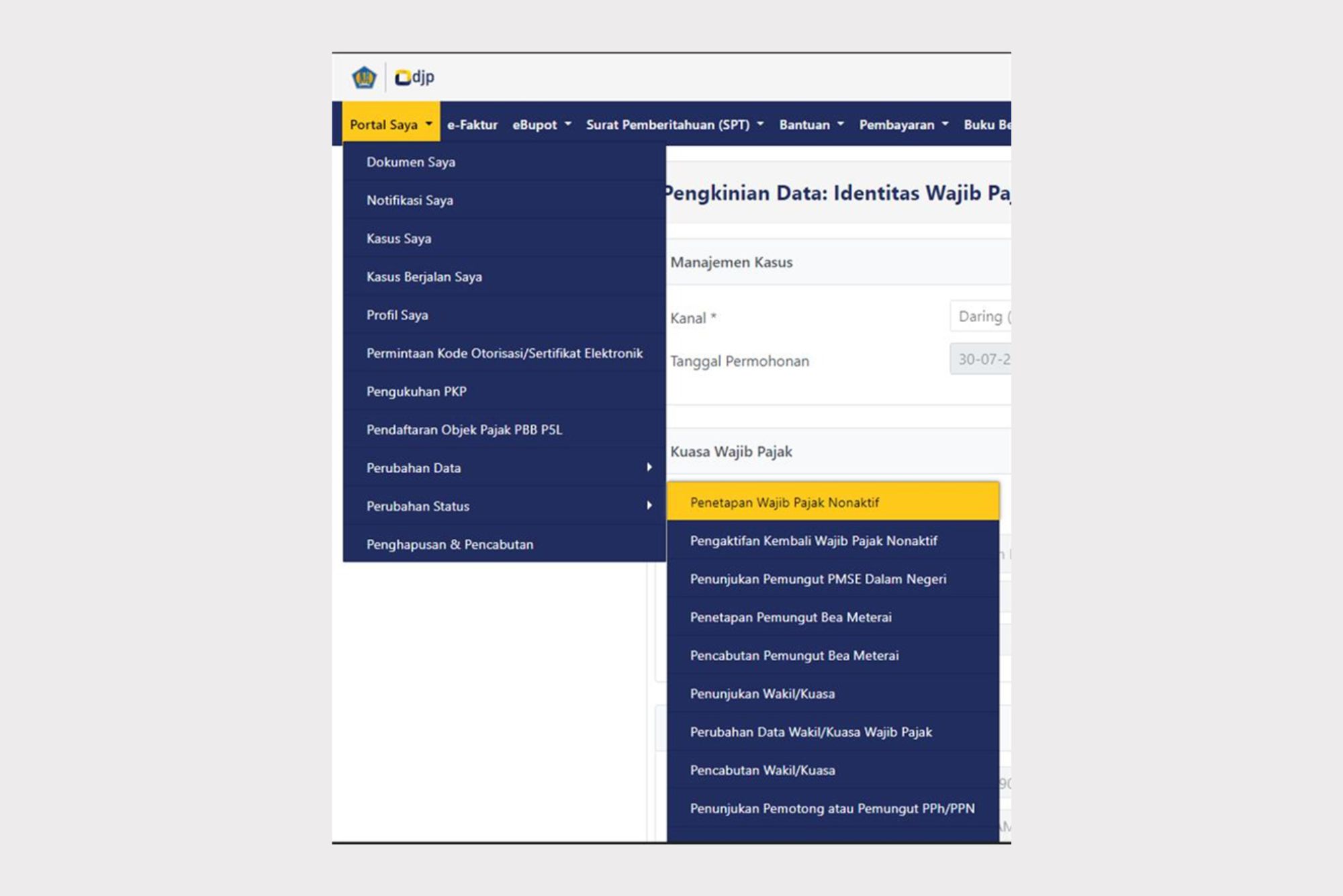

The process of deactivating the wife’s TIN is carried out through the Coretax System. Several steps need to be followed. First, log in to your Coretax account, then select the My Portal menu, and proceed to the Status Change section. The next step is to click on Non-Active Taxpayer Designation.

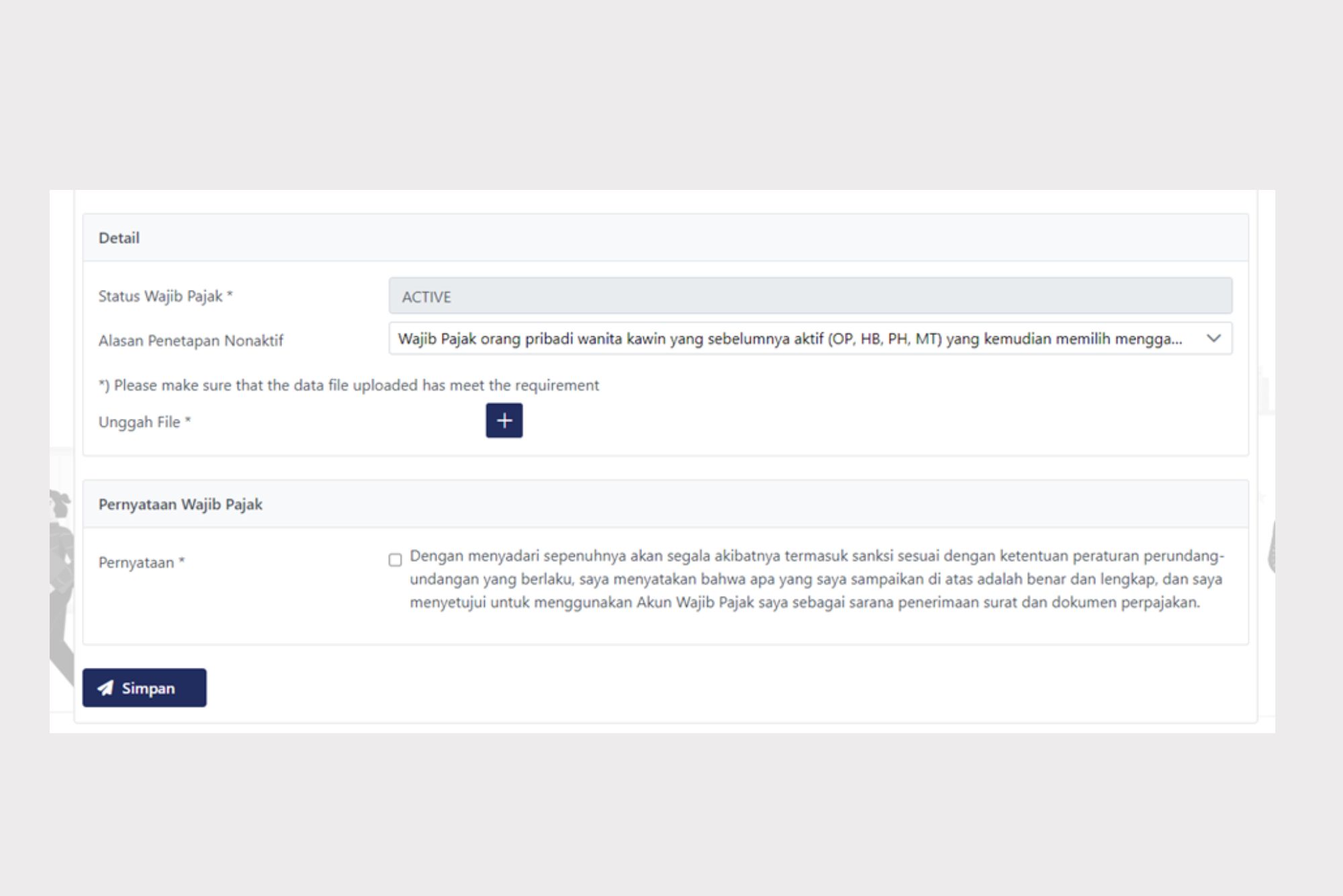

A new window will then appear containing several input fields, such as Reason for Non-Active Designation, Upload File, and the Taxpayer Declaration checkbox that must be ticked.

In the field for Reason for Non-Active Designation, you can fill it in with the statement: “A married female individual taxpayer who was previously active chooses to merge her tax calculation with her husband.”Finally, click the Save button.

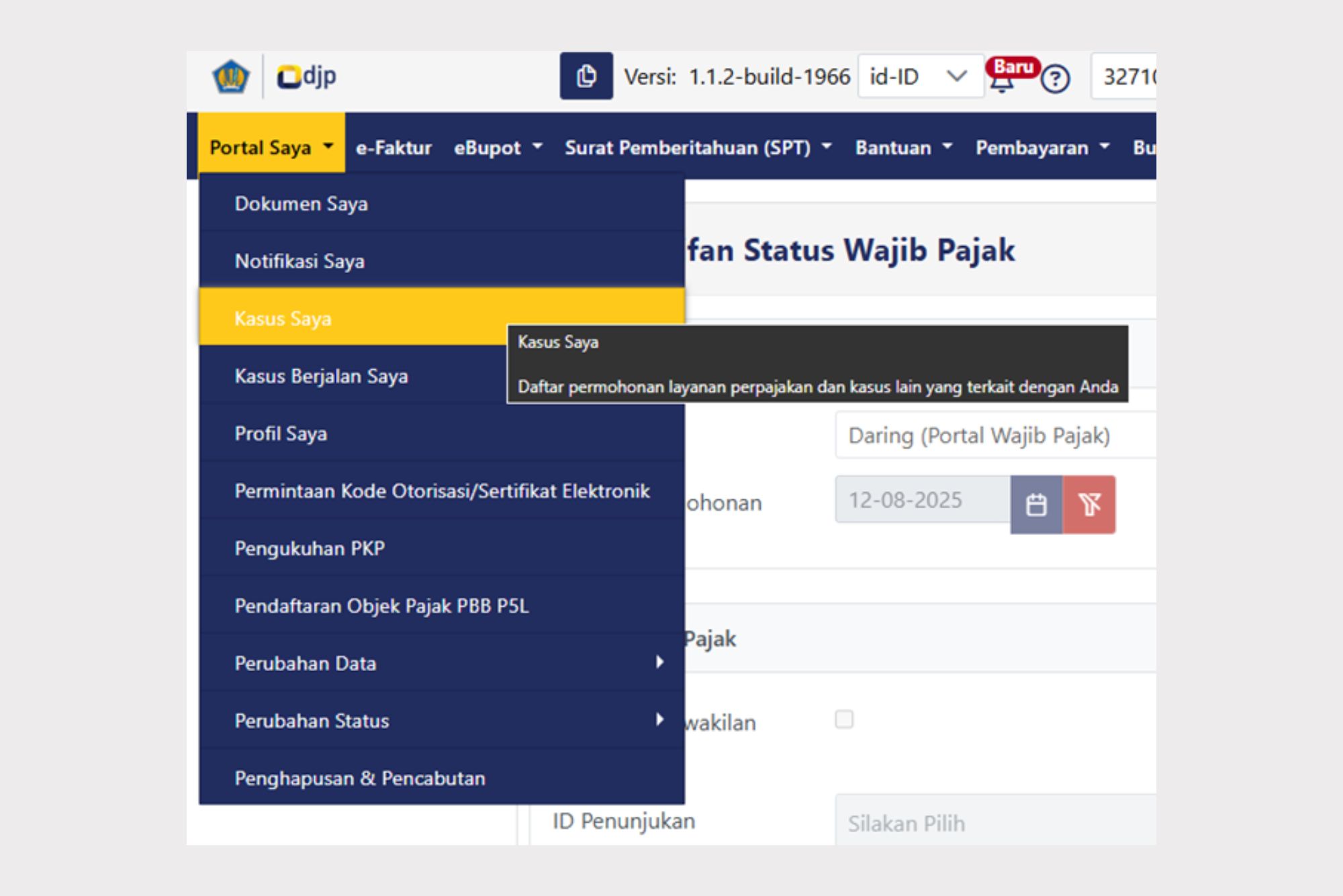

After that, you can monitor the progress of the Non-Active Designation request in Coretax by accessing My Portal and selecting "My Cases" section, which contains a list of tax service requests. Once approved, the Directorate General of Taxes (DGT) will issue a Non-Active Taxpayer Designation Letter.

2. Adding to the Husband’s Coretax Account

The next step in merging the husband’s and wife’s Tax ID Numbers (TINs), after deactivating the wife’s TIN, is to add her to the husband’s Coretax account. This is because, in fulfilling her tax obligations, the wife will subsequently use the husband’s TIN as part of the Family Tax Unit.

The steps to be followed are as follows: first, access the husband’s Coretax account. Then select the My Portal menu and the My Profile section.

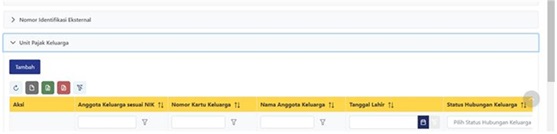

On the My Profile page in the husband’s Coretax account, select General Information and click the Edit button. After that, select the Family Tax Unit menu, then click the Add button.

The next stage is to fill in the wife’s details, such as National Identification Number (NIK), Gender, Place of Birth, Family Card Number, Family Member’s Name, Date of Birth, Family Relationship Status, Occupation, Tax Unit Status, Non-Taxable Income Status (PTKP), Start Date, and End Date.

Once all the data is filled in, click the Save button, and the wife will now be recorded under the husband’s Family Tax Unit in Coretax. The final step is to tick the Taxpayer Declaration box, then click the Submit button.

Tax Obligations After TINs Are Merged

After the TIN merger is completed, in fulfilling her tax obligations, the wife may use the husband’s TIN, while the wife’s NIK will serve as a valid tax identity. This means the wife’s NIK will still be recorded in the Coretax system.

Furthermore, if the wife is employed by an employer, her income only needs to be reported in the husband’s Annual Individual Withholding Income Tax Return (SPT), as income subject to final tax. Good luck. (GHF/ASP/KEN)