Tax Collection Letters: Causes and Settlement Procedures via Coretax

In principle, Indonesia adopts a self-assessment taxation system. Under the self-assessment approach, taxpayers are required to calculate, pay, and report their own tax obligations.

However, the Directorate General of Taxes (DGT) has the authority to ensure that taxpayers fulfill these obligations correctly. Therefore, supervision is necessary.

As a result of this tax authority’s supervision, taxpayers may be declared to have an underpayment. For any resulting underpayment, the DGT will issue a Tax Collection Letter (STP).

It is important to note that an STP carries the same legal force as a Tax Assessment Letter (SKP).

Why the DGT Issues an STP

Article 14 of the Law on General Provisions and Tax Procedures (KUP), as amended by the Law on the Harmonization of Tax Regulations (HPP), outlines several reasons why the Directorate General of Taxes (DGT) may issue a Tax Collection Letter (STP). Some of these include:

- The taxpayer’s Income Tax for the current year is unpaid or underpaid

- Underpayment of tax due to clerical or calculation errors, based on a review

- The taxpayer is subject to administrative sanctions in the form of fines or interest

- A VAT-registered person (PKP) fails to issue a tax invoice or issues it late

- A PKP does not complete a tax invoice properly (except for buyer identity in retail transactions)

- Interest compensation is granted to a taxpayer when it should not have been

- Tax amounts remain unpaid or underpaid within a certain period in relation to tax payment extensions or postponements

STP Issuance Time Limit

The issuance of an STP is subject to a time limit of a maximum of five years from the date the tax becomes due, or from the end of the tax period, part of a tax year, or the tax year itself. However, this time limit does not apply to the following:

First, STPs related to administrative sanctions may be issued up to the expiration of the collection period for underpaid Tax Assessment Letters (SKP), additional underpaid Tax Assessment Letters (SKPKBT), correction decisions, objection decisions, as well as appeal and judicial review decisions that increase the tax payable.

Second, STPs related to administrative sanctions under Article 25 paragraph (9) of the KUP Law may be issued up to five years from the date of the objection decision, if the taxpayer does not file an appeal. Third, STPs related to administrative sanctions under Article 27 paragraph (5d) of the KUP Law may be issued up to five years from the date the tax court’s appeal decision is pronounced.

Paying the Tax Principal and Administrative Sanctions

In addition to paying the principal tax amount that was underpaid or not paid, the DGT will also impose administrative sanctions, either in the form of interest or fines, in the Tax Collection Letter (STP).

Interest sanctions apply to STPs issued due to underpaid or unpaid Income Tax within a tax year, as well as underpaid tax arising from miscalculations or clerical errors. The applicable interest rate is stipulated and announced monthly by the Minister of Finance through a Minister of Finance Decree (KMK) on administrative sanction interest rates.

Meanwhile, fines may be imposed if the STP is issued because a VAT-registered person failed to issue a tax invoice, issued it late, or did not complete the tax invoice in accordance with regulations.

The administrative fine that must be paid is 1% of the Tax Base (DPP).

How to Settle an STP Through Coretax

Taxpayers can settle the tax payable listed in the Tax Collection Letter (STP) through the Coretax administrative system. Below are the steps for paying an STP through Coretax.

1. Access the Tax Payment Menu

Log in to your Coretax account, select the Payment menu, and click the Billing Code Creation for Tax Collection submenu.

_1760333502.jpg)

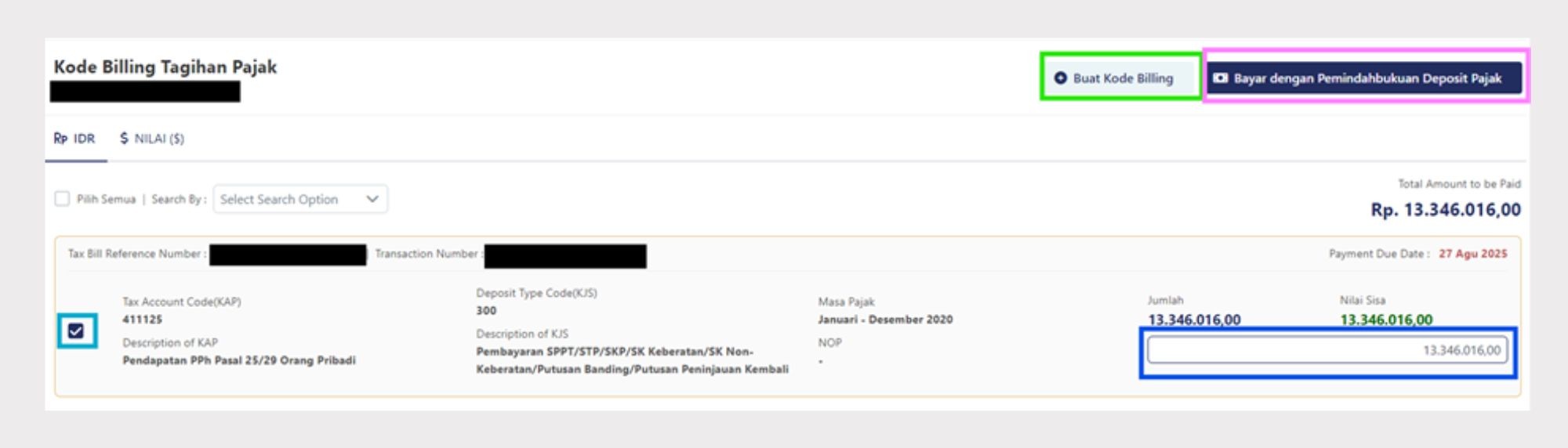

2. Create a Billing Code

Next, taxpayers can proceed with the payment by generating a billing code. Here are the steps:

- Tick the checkbox highlighted in yellow.

- Fill in the field highlighted in blue with the payable amount as stated in the STP.

- Click the Create Billing Code button highlighted in green to generate the Billing ID, or click Pay Using Tax Deposit Transfer highlighted in purple.

3. Download the Billing Code

After clicking Create Billing Code, the Billing ID will automatically be downloaded.

If the option chosen is Pay Using Tax Deposit Transfer, the balance will automatically be deducted according to the payable amount.

STP Cancellation

It is important to note that the DGT (Directorate General of Taxes) may reduce or cancel an issued STP. This can be done based on a request submitted by the taxpayer either directly, via mail, or through other available channels.

In accordance with Article 17 of the Minister of Finance Regulation (PMK) Number 8/PMK.03/2013, such reduction or cancellation can only be made for STPs that are incorrect and related to the issuance of a Tax Assessment Letter (SKP), and STPs that are incorrect but not related to an SKP. (ASP/GHF)