Unpacking Coretax Implementation Barriers: A Joint Initiative by MUC and KIIC

JAKARTA. MUC Consulting, in collaboration with PT Maligi Permata Industrial Estate, held a Taxation Update seminar focused on current regulations and emerging issues related to the implementation of the Coretax system.

The event occurred on Wednesday, May 7, at the Multi-Purpose Room, Graha KIIC, located within the Karawang International Industrial City (KIIC) industrial estate managed by PT Maligi Permata Industrial Estate.

The seminar was attended by dozens of participants representing companies, both from within the KIIC area and from outside the industrial estate.

The speakers at the event included Evy Suryany, Manager of Tax Compliance at MUC Consulting, and Daffa Abyan, Senior Tax Compliance Associate. Also in attendance was Sigit Wibowo, Tax Compliance Partner at MUC Consulting.

Benefits of Using Coretax

In his keynote speech, Sigit emphasized the importance of the Coretax system for taxpayers. He pointed out that, with all its available features, fulfilling tax obligations can become more effective and efficient.

Furthermore, the practitioner, who has more than 20 years of experience, also assessed that Coretax, on the other hand, provides convenience for the tax authority in carrying out supervision.

“With Coretax, all data will be integrated. Moreover, with the implementation of financial information exchange, all data will be transparent,” said Sigit.

Nevertheless, he stated that this should not be a reason for us to avoid using Coretax. On the contrary, taxpayers are expected to understand how to use Coretax to avoid the risk of errors that could lead to tax disputes.

READ: DGT Announces Coretax System Upgrade, Claims Faster and More Accurate Tax Services

Issues with Coretax

Previously, the Directorate General of Taxes officially implemented the Coretax system as its tax service platform starting from January 1, 2025. However, after being in operation for several months, there are still several services that taxpayers have not been able to use optimally.

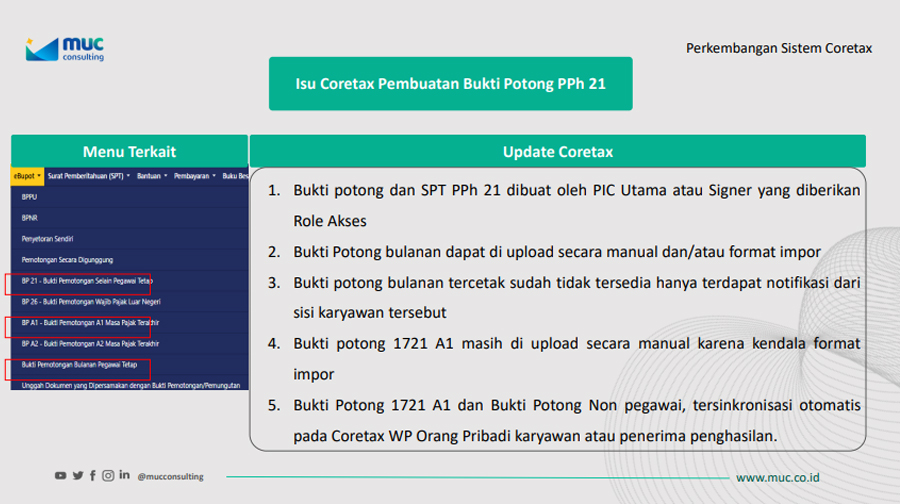

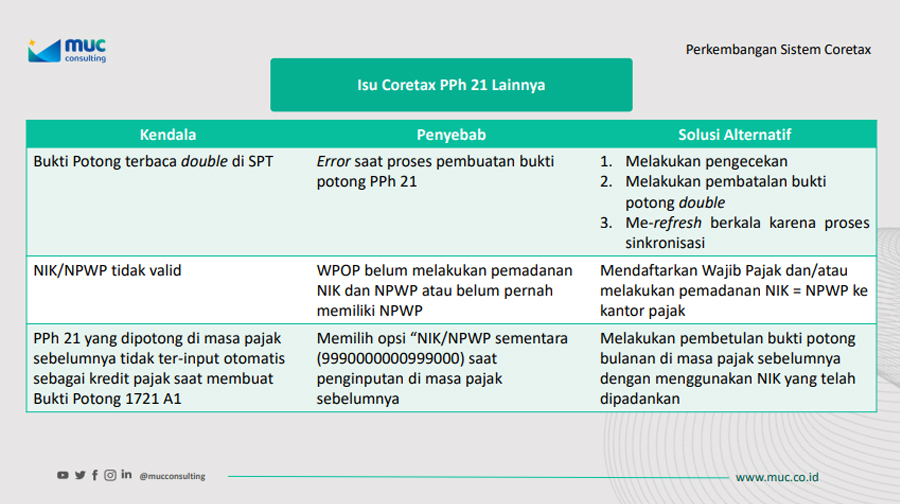

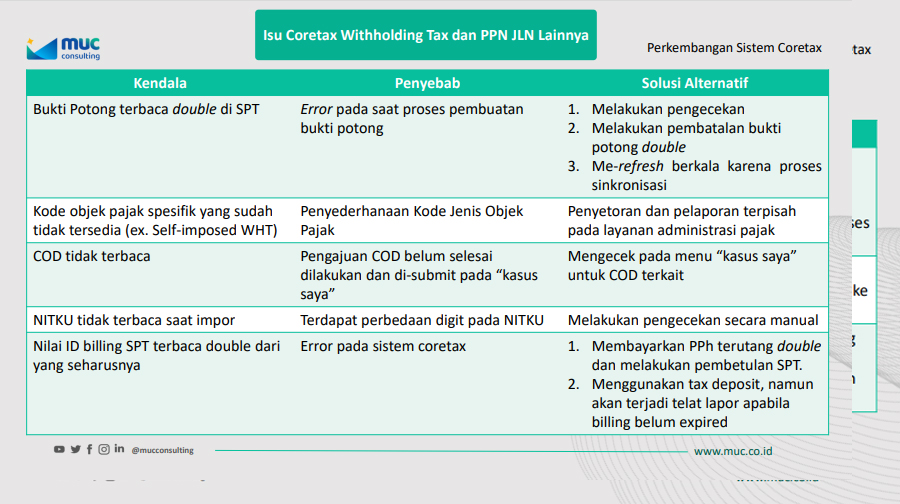

Some of the common issues reported by taxpayers regarding the use of Coretax include, difficulties in generating Withholding Income Tax Article 21 slip, Taxpayer Identification Numbers (Tax ID) being deemed invalid, issues related to withholding tax and Value Added Tax (VAT) on Foreign Services (JLN), problems in creating Unified Withholding Tax slip (PPh Unifikasi), difficulties in generating output tax invoices and other related technical or operational challenges.

During the event, participants were given the opportunity to ask questions—both regarding the material presented and the challenges they faced when accessing the Coretax system.

Tax and Legal Consultation Session

In addition to delivering a taxation update seminar, MUC Consulting also hosted a Tax and Legal Clinic. This event provided a free consultation session on various tax and legal topics.

The tax topics available for consultation include Tax compliance, Transfer pricing, Tax disputes and ,Tax advisory

Meanwhile, legal topics covered matters related to corporate legal affairs, such as corporate legal compliance concerning business legal documents, licensing, and cooperation agreements

This session was held on Thursday, May 8, at the Multi-Function Hall of Graha KIIC and was attended by a number of VAT-registered persons (taxpayers). Consultations were offered free of charge and could be conducted in Bahasa Indonesia, English, or Japanese. (ASP/KEN)