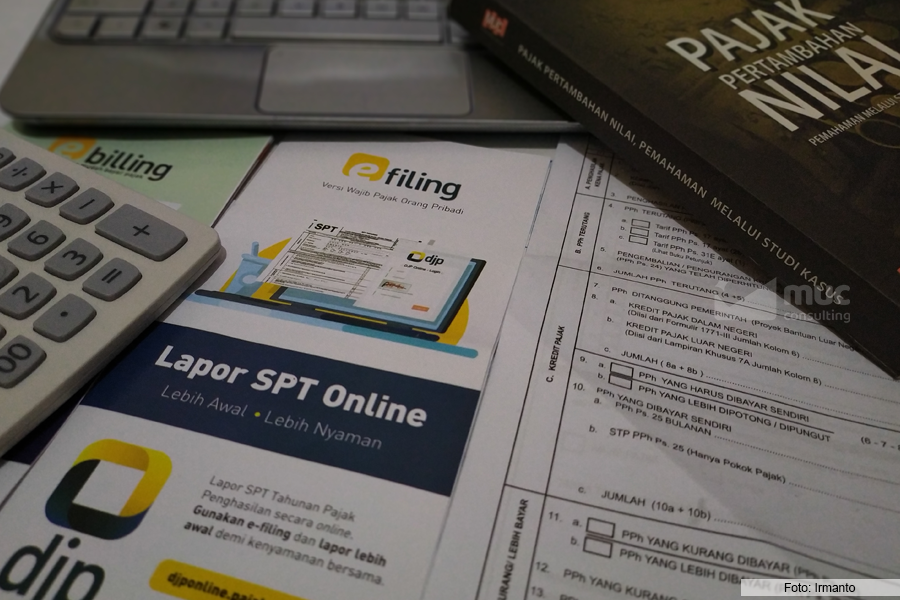

Annual Tax Filing Compliance Rises 3.26% Ahead of Penalty Waiver Deadline

JAKARTA – As of the April 11, 2025, deadline for the administrative penalty waiver for late submission, a total of 12.79 million Annual Tax Returns (SPT) had been filed, marking a 3.26% increase compared to the same period in 2024.

According to Kontan.co.id, when broken down by taxpayer type, individual tax returns increased by 3.08%, while corporate tax returns saw a higher growth of 9.64%.

Meanwhile, citing Bisnis.com, the Directorate General of Taxes received 12.44 million individual tax returns and 474,000 corporate tax returns.

Reaches 78.9% of Target

According to cnbcindonesia.com, the number of Annual Tax Returns (SPT) received by the tax authority has only reached 78.9% of the set target, which is 16.21 million.

As previously reported, the DGT had granted a filing extension for individual taxpayers, whose original deadline was March 31, 2025, or three months after the end of the tax year.

Meanwhile, the filing deadline for corporate taxpayers remains April 30, 2025, or the end of the fourth month following the close of the tax year.

READ: DGT: No Sanctions for Late Annual Tax Return Filing Until 11 April 2025

Provision on Late Filing Penalty Waiver

The relaxation took the form of an administrative penalty waiver for late annual tax return filings, granted for submissions made after the original deadline but no later than April 11, 2025.

This policy is outlined in the Director General of Taxes Decree No. KEP-79/PJ/2025, which was issued and took effect on March 25, 2025.

The waiver was granted because the annual tax return deadline coincided with Nyepi (Saka New Year 1947) and the Eid al-Fitr 1446 Hijri holiday period.

Late Filing Penalties for Annual Tax Returns

Under normal provisions, if the Annual Tax Return (SPT) is filed after March 31, an administrative penalty applies IDR 100,000 for individual taxpayers and IDR 1 million for corporate taxpayers

The obligation to submit an annual tax return applies to all individuals and entities that hold an active Taxpayer Identification Number (TIN/NPWP). (ASP/KEN)